Since the start of the crypto craze, one of the main arguments on crypto is its use as a hedge against inflation.

Are Cryptocurrencies a hedge to Inflation? Fiat Money, Money printing, and quantitative easing are all arguments in favor of decentralized money where no one (in principle) can alter the money supply. But are these arguments correct? What are the causes of inflation?

What is Inflation?

Inflation is the widespread and sustained increase in the prices of goods and services in a country over a sustained period, usually measured over one year. People purchase fewer goods and services with each currency unit when the general price level rises. In other words, inflation reflects the decrease in the currency’s purchasing power: a loss of the real value of the medium of exchange and unit of measurement of an economy. Governments and organizations use indexes to track and measure inflation growth, reflecting the percentage growth of a weighted ‘basket of goods.’

What causes inflation?

Inflation by consumption or demand. This inflation obeys the law of supply and demand. Prices tend to increase if demand for goods exceeds the capacity to produce or import them.

Inflation by rising costs. This type of inflation occurs when the price of raw materials (copper, oil, energy, etc.) increases, making producers raise their prices to preserve their margins.

Self-built inflation. Occurs when economic agents expect a substantial price increase and then begin to adjust so that the increase is gradual.

Inflation due to Fiscal policies. Central banks control the amount of money circulating in our societies. Excessive money printing can produce inflation. According to their definition, the macroeconomy theory segments these amounts (money aggregates) under different names: M1 is the sum of all currency (banknotes and coins) plus overnight deposits. M1 is also known as Narrow Money. Broad money (M3) includes M1, deposits with an agreed maturity of up to two years, REPO agreements, and other money instruments (See the exact definition of monetary aggregates.)

Inflation generated by inflation expectations

In countries with high inflation levels, workers ask for wage increases to counteract the inflationary effects, which leads to a rise in prices by employers, causing a vicious circle of inflation.

How do governments manage inflation?

Central banks tend to increase the interest rate on public debt to stop inflation. This increases consumer loan interest rates (credit cards, mortgages, etc.). As consumer interest rates rise, demand for products slows down. The negative side of this control is that slowing down the demand for products and putting a brake on producing goods and the industries that produce them leads to economic stagnation and unemployment.

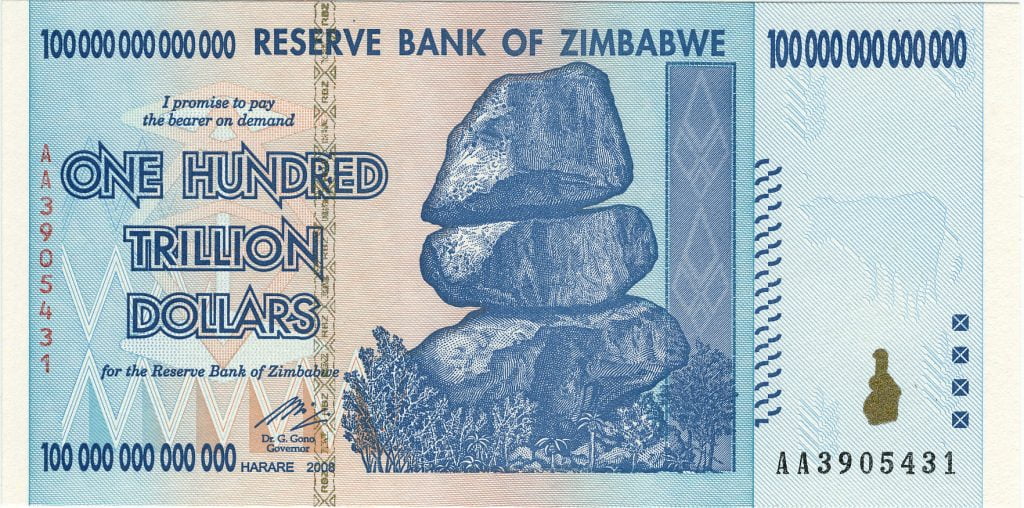

As a financial instrument, fiat money is also under offer-demand laws. When a government prints money, increasing the available cash, the value of money decreases. There are more banknotes for the same economic output. Consumers can buy fewer things with the same amount of money. Hyperinflation occurs when the people in charge of printing money lose control because of external/internal pressures or simply because they don’t understand how the economy works. (See Hyperinflation in Zimbabwe or, if you think Europe is different, Worthless money in the Weimar Republic, Germany). Many countries have launched fiscal strategies worldwide to curb the coronavirus pandemic’s economic repercussions. The outcome of these policies is yet to be seen.

Does crypto avoid inflation?

By design, many crypto coins have an upper limit to their availability (offer). For example, the maximum amount of bitcoin is 21 million units, although not all have been mined (minted) yet. Crypto-producing algorithms resemble gold production: There is not infinite gold in the earth’s crust. The production speed is limited to mining operations worldwide, becoming increasingly difficult as mines get depleted of precious metal. Another important characteristic of blockchain coins is that the production process is decentralized. No one can alter or tamper with coins’ production, preventing governments (or economic groups) from mismanaging the coin offer. As stated above, cryptocurrencies only address one of the causes of inflation.

Why is Bitcoin compared to gold?

Gold has historically been a safe investment as a scarce commodity. Governments can print more and more banknotes, thus deteriorating their currencies, but miners cannot cheat gold markets. Part of bitcoin’s attraction is to discourage governments or their monetary and fiscal policy from misregulation and to reduce the coin production more narrowly than gold: halving will help delay the mining of new coins and willfully end at the mentioned 21 million coins.

The functions of money (and Crypto?)

As an alternative to the barter system (localized and ineffective), money must have some functions:

Use as a medium of exchange

When you go to a store and buy a pair of shoes, the store clerk hands you the shoes you have chosen, and you give them the money they cost. This property is the primary function of money, to facilitate exchange because it is a conventional good generally accepted and guaranteed by the state (more on this later). Volatility in prices is one main reason crypto can not be used as a medium of exchange, at least for now (See the Bitcoin Pizza Day). Some altcoins are trying hard to resolve this issue.

Store of value

Usually, purchased goods are perishable, and Services aren’t physical and can’t be stored. Money, as a representation of wealth, must have the ability to be preserved over time. It must also be possible to store money conveniently to make it usable later without losing value.

Unit of account

Money must act in a standardized way in society to measure wealth. The actors in the market can agree on the price (amount of money) of a specific good; thus, a transaction occurs. You use money as a universal unit of account to measure the value of goods.

Deferred payments

When people agree on some transactions using contracts that require future payments, the agreement must specify the price under specific monetary terms: It must be possible to express debts in terms of money.

Legal Tender?

The money issued by governments is called legal tender. Legal tender means that you are obliged to accept government-issued money as a payment for a debt. Nations can use coercive measures to enable this property. None of the currently used crypto monies is legal tender because it relies on trust in the system to achieve the same result.

The Value of Trust

Since the link between money and gold broke some decades ago, one of the most important things money needs is people’s Trust. Governments build this Trust with their economic production or even military power.

Suppose a society that does not trust its money. In that case, it will use some other available medium of exchange, other countries’ money, or some cryptocurrency (see how Argentinians are coping with inflation or how Venezuela does not want to use its currency). The loss of money value (its purchasing power) is debasing. The term came from antiquity when the mints mixed pure gold (or silver) coins with other, cheaper metals: They could issue or mint more cash with less precious metal.

Conclusion

If you’re pro or even against Bitcoin or cryptocurrencies in general, one thing is certain: it opened the way for the boom in cryptocurrencies we see today. Although the financial crisis of 2008 resulted in the birth of Bitcoin and bigger use of blockchain, this recession will be the one that determines digital tools in general. There is a continuing proliferation of new digital assets that learn from their predecessors and show significant advancement (See the post What is Cardano?).

This evolution implies a broader use of virtual currency, stablecoins, automated central bank currencies, tokens sponsored by commodities such as gold, and security tokens. Improving cryptocurrency’s usability and user experience is imperative: wallets, account IDs, etc. The blockchain community must build Trust around cryptocurrencies. Fraud is one of the biggest problems in the crypto ecosystem. History has taught that perhaps the crisis is fading, and new prospects are coming. If the next recession follows, gold and bitcoin will most certainly be a valuable medium of exchange. Virtual currencies will allow real reform in the financial sector and decentralized markets and economies to contribute to more efficient economic institutions balanced in the best ways (centrally controlled and decentralized).