On-chain analytics firm highlights the predictability of Bitcoin halving amid uncertain global financial conditions.

- CoinMetrics says miners will need to perform their work more efficiently and sustainably.

- New technological developments in Bitcoin will boost the BTC market.

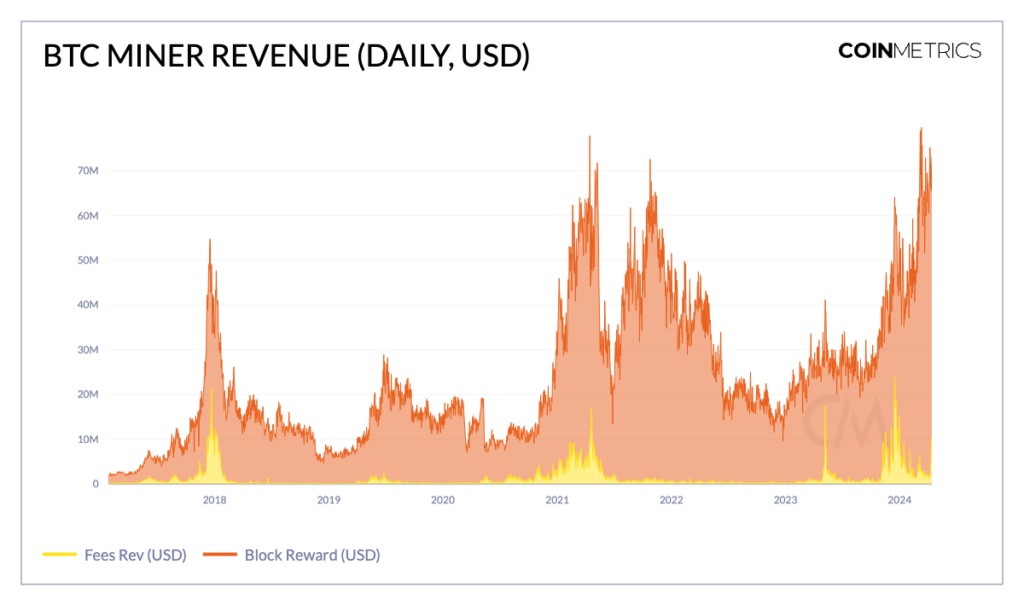

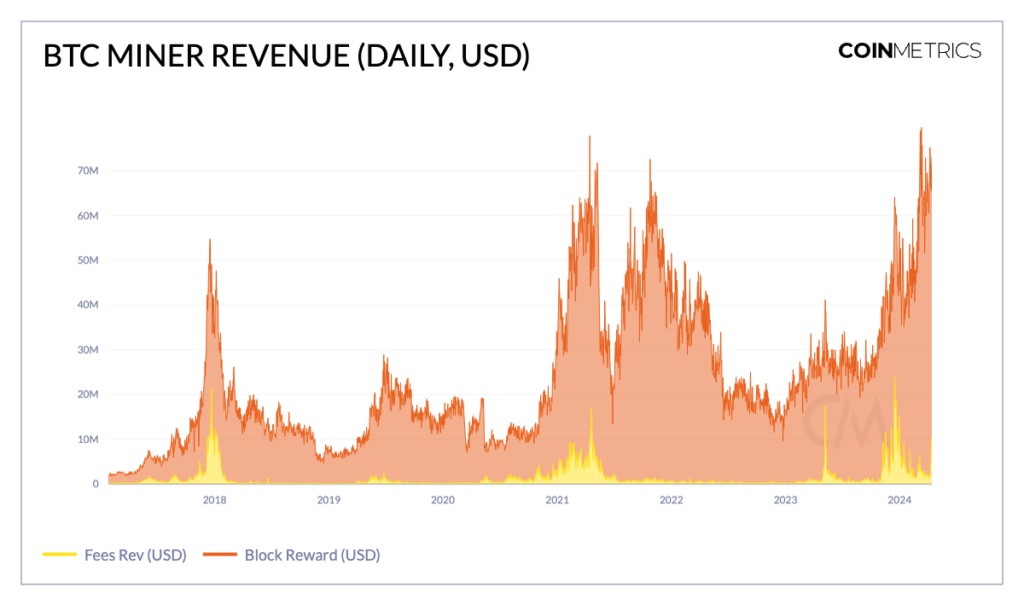

CoinMetrics, an on-chain analytics firm, recently released a report reflecting bullish expectations for bitcoin (BTC) after halving. “The convergence of this supply-side event and strong demand drivers suggest that Bitcoin is ready for its next phase of growth,” it expressed in the report. The company explains that each halving is critical in Bitcoin’s lifecycle. It reduces the digital currency issuance by 50%. In this sense, it decreases the supply launched to the market, causing the asset price to rise. The price movement is not instantaneous, as miners can flood the market by selling holdings from earlier.

“Amid the current environment of macroeconomic uncertainty, with persistent inflation and looming fed funds rate cuts, the ripple effects of the upcoming election cycle, geopolitical tensions and record debt levels, one event stands out as a beacon of certainty: bitcoin’s fourth halving.”

CoinMetrics is a provider of on-chain data and market analytics.

The bitcoin halving, which occurs automatically every four years or so, will happen for the fourth time in history this Saturday, April 20. CoinMetrics argues that, 15 years after the currency’s launch, this is a pivotal event for its economic policy and value proposition on the global stage. It also indicates that halving challenges miners to perform their work more efficiently and sustainably to remain profitable.

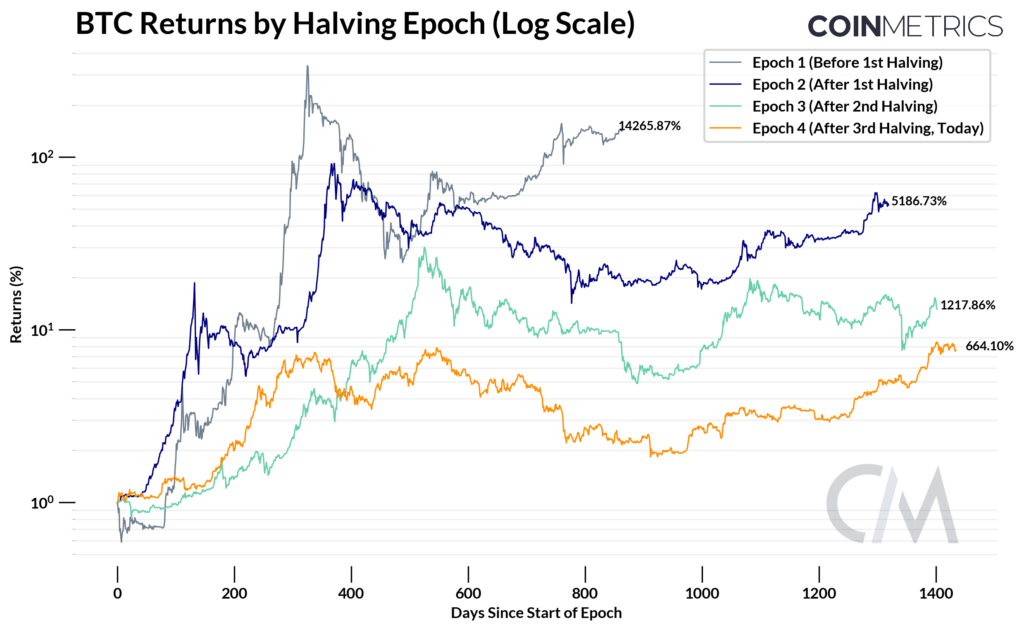

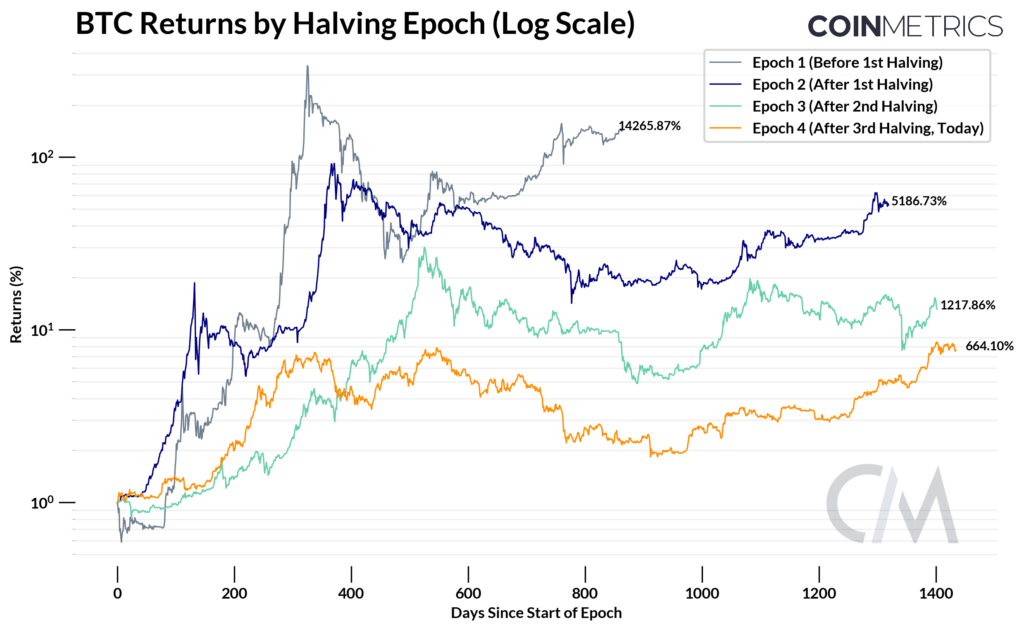

The analyst company highlights that the bitcoin market tends to move in four-year cycles. You can appreciate in the chart below that the currency has appreciated significantly in the year following each halving. This pattern suggests promising gains for 2024-2025 if repeated.

ETFs reflect an “outsized role” for Bitcoin’s future upside

CoinMetrics stresses that while halving plays a crucial role in supply, demand is critical in driving the value. It argues that each Bitcoin bull cycle has had different aspects motivating buying strength, which we’ll see in the current one. He specifies that the launch of BTC exchange-traded funds (ETFs) launched in the U.S. this year has catalyzed a substantial source of new demand. He indicates that it has accelerated the price rise to a new all-time pre-halving high, which has never happened before.

“The role of ETF-induced demand and subsequent attention has resulted in a slightly different dynamic and promises to play a mammoth role going forward,” he comments. For the firm, capital inflows into bitcoin ETFs in the U.S., along with those recently approved in Hong Kong and other sources of demand, would help to absorb the pressure of forced selling and reduced supply effectively. In addition, they can boost price action, he notes.

Broader macroeconomic and liquidity changes, regulations, growth in global digital asset adoption, and speculation are other factors that he believes could provide a demand boost. This report comes as the escalating conflict in Israel drove the broader markets, including bitcoin, lower this week.