Fees in Ethereum have been a target of criticism from the community. Fees are the first cause of blockchain switching.

In Short

- Fees on Ethereum are, on average, above $26 this February 2, 2022.

- Bitcoin transaction fees average $2, according to BitInfoCharts.

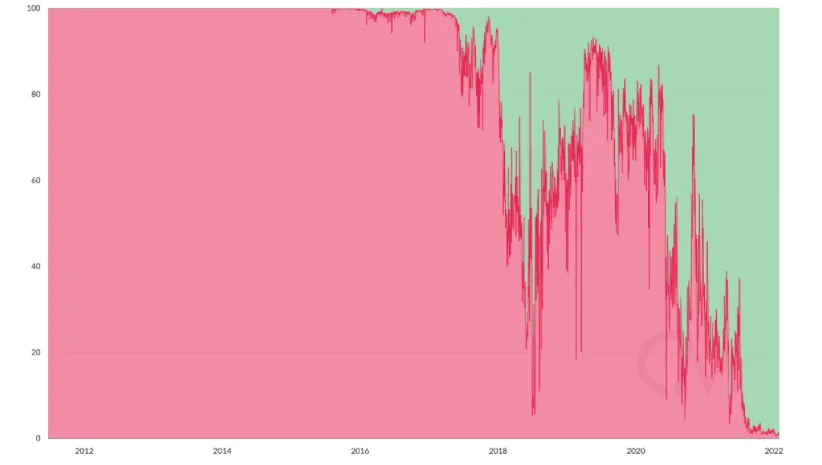

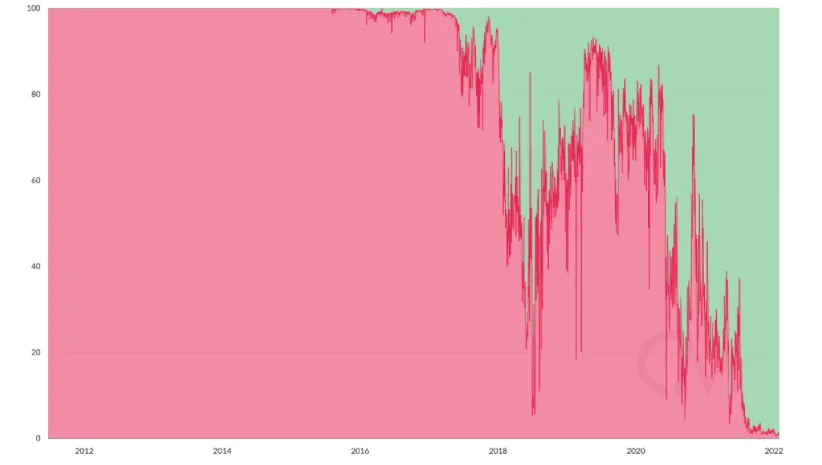

Bitcoin fees are 99% lower than Ethereum’s. Bitcoin’s (BTC) low fees are sometimes notable. In recent months, users of this blockchain have paid just 1% of what they would have to write off in usage fees on the Ethereum (ETH) network, the second-highest-valued blockchain on the market. The graphics from Coin Metrics, analyzing the percentage of payments for fees over time, suggest that Bitcoin is at 1% concerning Ethereum in the number of money people must pay to use the network.

Such difference is possibly in response to the fact that conceptually speaking, Ethereum is not a value settlement and storage network, as highlighted by Dylan LeClair, head of market research at Bitcoin Magazine.

However, it is somewhat subjective, considering that each person or company can put the blockchain to individual users according to their needs. An example might be an institutional investor with no problem using Ethereum for settlement or storage. The same with ordinary users, who already have some ETH in their wallets; they give it thrifty use.

High fees, the burden on the Ethereum network

The high fees in Ethereum have been the subject of criticism from the community. The leading cause is network congestion, which translates into canceling large commissions.

There have already been episodes of congestion in the past:

- CryptoKitties, in 2017

- Decentralized finance (DeFi) in 2020

- 2021, the rise of play-to-win (play-to-earn) and Non-Fungible Tokens (NFT)

Ethereum developers, to solve the problem, want to quicken the pace for Ethereum 2.0, a network where there would be more accentuated scalability solutions and lower fees to use the network. However, the arrival of ETH2 is likely to be achieved in 2023.

The difference between Bitcoin and Ethereum is clear: people only use the first blockchain for money transfers. While in the second, there is a whole web of Smart Contracts that load the network and congest it.

Users are leaving Ethereum due to high fees

Many users left the Ethereum network, preferring other solutions due to the high fees, which were the first cause of blockchain switching. In December, for example, fees exceeded $20 per transaction on average, according to Etherscan data. Right now, gas, as it is also known, is above $26, according to BitInfoCharts.

By comparison, transaction fees on the Bitcoin network are, on average, above $2.09, according to the same source. Low costs translate to little congestion on the blockchain with the highest market valuation.

2021 was a nightmare year for Ethereum fees, as the arrival of more users congested the network and consequently, the price of commissions to trade increased significantly.

Because of that, other blockchains started to grow, as many users of various decentralized applications took notice of other blockchains, such as Binance Smart Chain or Solana‘s, which took much of the market dominance during the year just ended.